Claims Made Policies in Summary:

Professional Indemnity policies are issued on a 'Claims Made' basis. That means that claims and any fact, situation or circumstance that may result in a claim needs to be notified to the Insurer within the Period of Insurance. The actual event could occur at any time back to the retroactive date; however the notification must be made during the Period of Insurance. The Insured must not have had any prior knowledge of the fact, situation or circumstance before the Period of Insurance

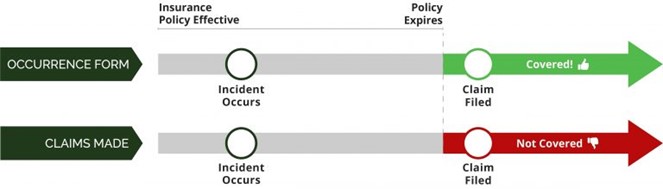

Occurrence Form - If you sell your car you can stop insuring it; motor vehicle insurance covers risks on an "occurrence" basis and once the car is gone so is the risk.

Claims Made- Professional indemnity cover is offered on a claims-made basis. Claims-Made policies must be active when the claim is reported in order to trigger coverage. In other words, any claim filed after a claims-made policy expires will not be covered, even if the incident in question took place while the policy was active.

Example: Your claims-made policy expired on Nov 30. One of your clients experienced pain after her deep-tissue session on Oct. 30, at which point you were insured. However, the claim isn't filed until Dec. 30, a month after your policy expired. You report the claim to your insurance provider only to find out that you're not covered because the claim was made after your policy term.

The Importance of Run-Off Cover:

Professional Indemnity insurance policies are written on a 'claims made' basis. This means that they will only respond to claims which are made against an insured and notified to the insurer during the policy period, irrespective of when the work was performed by the insured. If the policy expires, no additional claims can be made under the policy.

There is a potential for claims to be made against an insured after a business is wound up or a project is finished. If a claim is made at a time in the future and there is no insurance policy in place there would be no protection for the insured. This is where a run-off insurance policy can prove to be very valuable.

A run-off insurance policy can be purchased prior to cessation of the business or finalisation of a project. It will provide coverage to an insured for future claims made against them which arise from acts, errors or omissions which occurred prior to the inception of the run-off policy. Run-off policies can be purchased on an annual basis or a multi-year basis with one upfront premium payment.